A Quick Take On Raytech Holding Limited

Raytech Holding Limited (RAY) has filed to raise $13.5 million in an IPO of its ordinary shares, according to an SEC F-1 registration statement.

The firm sources production process capabilities for personal care electronic appliances.

Given RAY’s tiny size, ultra-high customer concentration risk, operating risks and high valuation expectations at IPO, my outlook on the IPO is to Sell [Avoid].

Raytech Overview

Hong Kong, PRC-based Raytech Holding Limited was founded to provide sourcing and wholesaling services of personal care electrical appliance products across a range of categories.

Management is headed by Chairman and CEO Mr. Tim Hoi Ching, who has been with the firm since 2010 and also serves as the Vice President of the Hong Kong Electrical Appliance Industries Association.

The company’s primary offerings include the following:

-

Hair styling

-

Trimmers

-

Eyelash curlers

-

Neck care

-

Nail care

-

Tooling

-

Others

The firm’s primary customer is Koizumi Seiki Corp., a large seller of personal care products in Japan.

For the year ended March 31, 2023, Koizumi accounted for 91.3% of the firm’s revenue, so Raytech’s revenue is extremely concentrated, which represents a high risk in case of loss or reduction from the Koizumi account.

As of March 31, 2023, Raytech has booked fair market value investment of $12,739 from investors, including Chun Yin Ling, Ace Challenger Limited and Wai Yi Look.

Raytech Customer Acquisition

The firm obtains customers via its direct sales, marketing and business development efforts and through trade shows and industry activities.

The company also develops relationships with personal electrical appliance manufacturers, which are primarily China-based companies.

Selling, G&A expenses as a percentage of total revenue have risen as revenues have increased, as the figures below indicate:

|

Selling, G&A |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Fiscal Year Ended March 31, 2023 |

9.4% |

|

Fiscal Year Ended March 31, 2022 |

3.1% |

(Source – SEC.)

The Selling, G&A efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling, G&A expense, was 0.1x in the most recent reporting period. (Source – SEC.)

Raytech’s Market & Competition

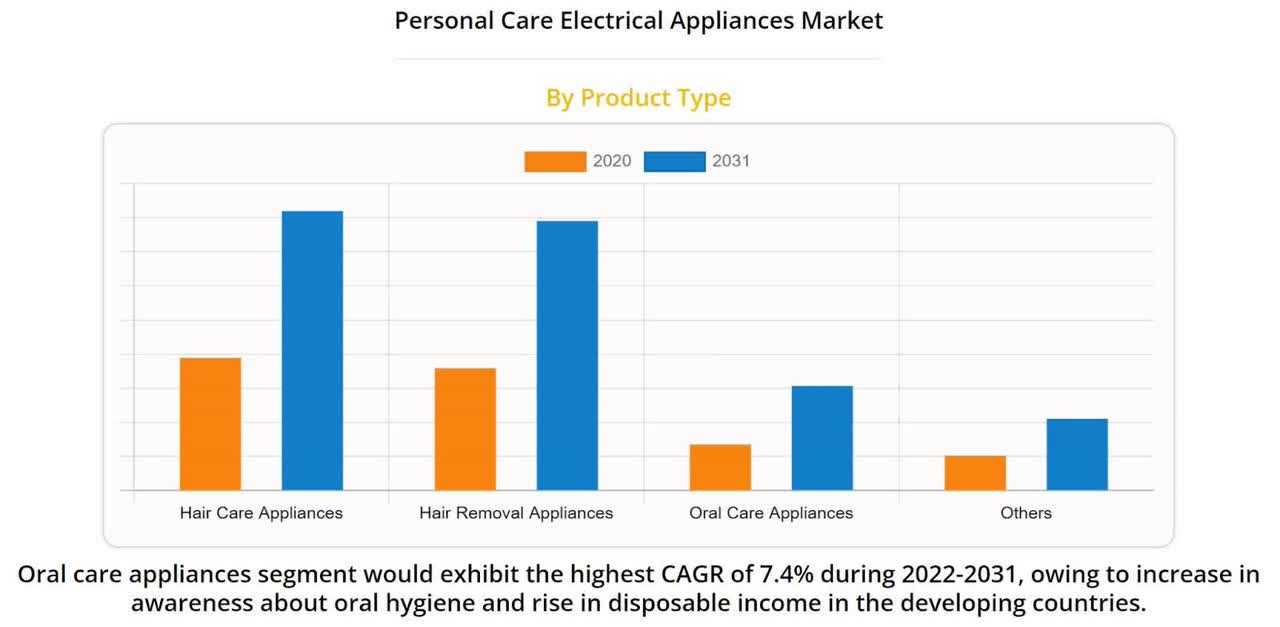

According to a 2022 market research report by Allied Market Research, the global market for personal care electrical appliances was an estimated $19.6 billion in 2020 and is forecasted to reach $42.5 billion by 2031.

This represents a forecast CAGR (Compound Annual Growth Rate) of 6.8% from 2022 to 2031.

The primary drivers for this expected growth are an increase in disposable income across developed and emerging markets and a desire by consumers for time-saving and appearance-improving products.

Also, the chart below shows the relative market size and expected growth for various product types:

Allied Market Research

Major competitive or other industry participants include the following firms:

-

Procter and Gamble

-

Conair Corp

-

Royal Philips Electronics NV

-

Panasonic Corporation

-

Groupe SEB

-

Colgate-Palmolive

-

Helen of Troy L.P

-

HoMedics Inc.

-

LION Corp.

-

Fenbo Holdings

Raytech Holding Limited Financial Performance

The company’s recent financial results can be summarized as follows:

-

Slowly growing topline revenue

-

Decreased gross profit and gross margin

-

Reduced operating profit

-

Higher cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Fiscal Year Ended March 31, 2023 |

$ 5,798,576 |

1.2% |

|

Fiscal Year Ended March 31, 2022 |

$ 5,728,451 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Fiscal Year Ended March 31, 2023 |

$ 1,461,414 |

-4.9% |

|

Fiscal Year Ended March 31, 2022 |

$ 1,537,262 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

% Variance vs. Prior |

|

Fiscal Year Ended March 31, 2023 |

25.20% |

-6.1% |

|

Fiscal Year Ended March 31, 2022 |

26.84% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Fiscal Year Ended March 31, 2023 |

$ 916,480 |

15.8% |

|

Fiscal Year Ended March 31, 2022 |

$ 1,362,003 |

23.8% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Fiscal Year Ended March 31, 2023 |

$ 801,650 |

13.8% |

|

Fiscal Year Ended March 31, 2022 |

$ 1,198,930 |

20.9% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Fiscal Year Ended March 31, 2023 |

$ 1,396,430 |

|

|

Fiscal Year Ended March 31, 2022 |

$ 1,045,076 |

|

|

(Glossary Of Terms.) |

(Source – SEC.)

As of March 31, 2023, Raytech had $2.7 million in cash and $1.5 million in total liabilities.

Free cash flow during the twelve months ending March 31, 2023, was $1.4 million.

Raytech Holding Limited IPO Details

Raytech intends to raise $13.5 million in gross proceeds from an IPO of its ordinary shares, offering three million shares at a proposed midpoint price of $4.50 per share.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Management has elected to register as a ‘foreign private issuer’ and an ‘emerging growth company’, which will enable it to provide substantially less information to public shareholders.

Such companies have generally performed poorly post-IPO.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $99.6 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 15.8%.

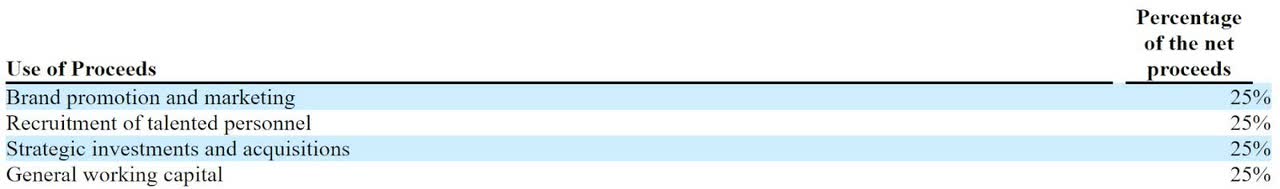

Management says it will use the net proceeds from the IPO as follows:

SEC

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the firm is not currently “a party to any material legal or administrative proceedings.”

The sole listed bookrunner of the IPO is Revere Securities.

Valuation Metrics For Raytech

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$85,500,000 |

|

Enterprise Value |

$99,610,773 |

|

Price / Sales |

14.74 |

|

EV / Revenue |

17.18 |

|

EV / EBITDA |

68.16 |

|

Earnings Per Share |

$0.05 |

|

Operating Margin |

25.20% |

|

Net Margin |

15.81% |

|

Float To Outstanding Shares Ratio |

15.79% |

|

Proposed IPO Midpoint Price per Share |

$4.50 |

|

Capital Expenditures |

$0 |

|

Free Cash Flow Yield Per Share |

0.00% |

|

Debt / EBITDA Multiple |

9.66 |

|

Revenue Growth Rate |

1.22% |

|

(Glossary Of Terms.) |

(Source – SEC.)

Commentary About Raytech’s IPO

Raytech Holding Limited is seeking U.S. public capital market investment for its general corporate and working capital purposes.

The company’s financials have produced very little topline revenue growth, reduced gross profit and gross margin, and lower operating profit but increased cash flow from operations.

Free cash flow for the twelve months ending March 31, 2023, was $1.4 million.

Selling, G&A expenses as a percentage of total revenue have risen as revenue has increased slightly; its Selling, G&A efficiency multiple was only 0.1x, indicating low efficiency in generating incremental revenue as a function of these costs.

The firm currently plans to pay no dividends and to retain any future earnings for reinvestment back into the firm’s growth and general corporate purposes.

The market opportunity for selling personal care electronic products is large and expected to grow at a moderate rate of growth in the coming years.

Business risks to the company’s outlook as a public company include its location and primary operations in Hong Kong and Mainland China, which have been subject to unpredictable regulatory and political developments in recent years.

Management is seeking an Enterprise Value/Revenue multiple of approximately 17.2x despite revenue growth that has essentially stopped.

Given the firm’s small size, high customer concentration risk, operating risks and high valuation expectations at IPO, my outlook on the Raytech Holding Limited IPO is to Sell [Avoid].

Expected IPO Pricing Date: To be announced.

Read the full article here